(States Newsroom) Washington As a final vote draws closer, the U.S. Senate began a lengthy amendment voting session Monday, where members will discuss scores of Republican and Democratic suggestions that could drastically alter the big, beautiful bill.

For senators who aren’t used to being on the floor all day and all night, the projected vote-a-rama is expected to continue throughout Monday and possibly into Tuesday. The Senate will vote on final approval at the end, and if the tax and spending cut plan passes, the House will consider it next, maybe as early as Wednesday morning.

Republicans’ choice to assess the bill’s fiscal effects using existing policy rather than current law was the main topic of Monday’s first significant discussion and vote.

The amount that legislation will add or deduct from annual deficits has historically been determined by Congress using existing law, particularly in the context of the budget reconciliation procedure being employed for this bill.

However, using the existing law baseline revealed much bigger deficits than using current policy because Republicans’ 2017 tax plan was due to expire at the end of the year, which may prove to be a political issue.

Even while the Senate discussion was shaky, it might have repercussions if Democrats ever gain unified control of the government and utilize the procedural change that GOP members adopted this time for their own policy objectives.

In a brief debate prior to the vote, Budget Chairman Lindsey Graham, R-S.C., stated that the GOP could make many of the tax levels in the 2017 law permanent under existing policy rather than needing to sunset them in order to comply with reconciliation rules.

Making sure the tax breaks don’t expire in ten years is what I’m attempting to do, and I’m really delighted about that,” Graham stated.

The deficit cannot be increased by reconciliation bills after the 10-year budget window has ended.

Although his arguments were eventually unsuccessful, Senate Democratic Leader Chuck Schumer of New York rebuked his Republican colleagues for using current policy over current law.

Schumer claimed that Republicans are using accounting tricks and phony math to conceal the bill’s actual cost, something the Senate has never done before. Republicans can attempt to make the math work on paper by using any budgetary tricks they like, but you cannot ignore the actual economic effects of adding tens of trillions to the debt.

The proposal would increase deficits by $3.253 trillion over the next ten years, according to the nonpartisan Congressional Budget Office’s current law score, which was revealed on Sunday.

Along party lines, senators voted 53-47 to uphold Graham’s choice to apply the present policy.

Narrow majority

For the next few hours, senators debated Democratic amendments to the plan that would have dealt with the Supplemental Nutrition Assistance Program and Medicaid. However, as of Monday afternoon, Republicans had not yet begun voting on their own amendments, and no Democratic ideas had been adopted.

The Senate will proceed to a final passage vote after both parties have exhausted their options. With Vice President JD Vance breaking the tie, GOP leaders can only afford to lose three members and still have the bill pass because of their slim 53-seat majority.

Late Saturday night, two Republican senators, Rand Paul of Kentucky and Thom Tillis of North Carolina, voted against moving the bill forward, indicating that they would oppose it. If the bill is changed, additional senators might object, which would make the entire process difficult for GOP leadership.

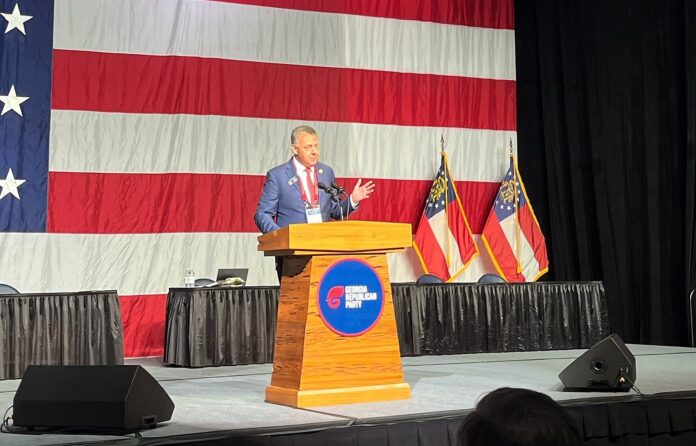

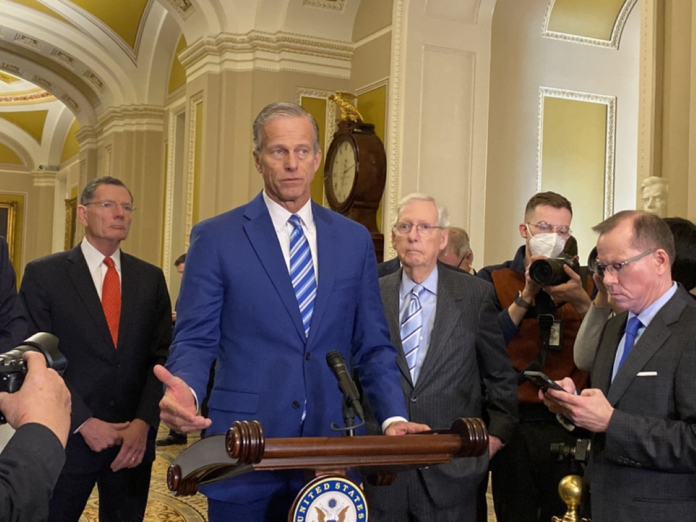

During a floor speech, Senate Majority Leader John Thune, R-S.D., stated that the main goal of the comprehensive package is to prevent a cliff that was formed when Republicans passed lower tax rates during President Donald Trump’s first term.

According to Thune, the goal is to prolong the tax break so that those who have benefited from it for the past eight years and in 2017 won’t be confronted with a huge tax rise on January 1.

Schumer harshly criticized the mega-bill’s spending cuts and policy changes, claiming they would make it harder for low-income individuals to access safety-net programs like the Supplemental Nutrition Assistance Program, which provides food assistance to low-income individuals, and Medicaid, which covers health insurance for low-income individuals and some individuals with disabilities.

How can a senator go home and apologize to their constituents for taking away their health insurance because they wanted to give millionaires tax breaks? uttered Schumer. However, Republicans are determined to approve a package that will destroy their own constituency, even if it means going off a cliff.

Wraparound amendment

The number of GOP senators who are willing to vote for the final version of the bill may rise or fall depending on the popularity of the amendment and the specific parts of the legislation it aims to improve.

Though if some do get added, Thune can utilize a procedural strategy known as a wraparound amendment at the end to remove any problematic modifications by eliminating Democratic amendments with a majority vote. Republican leaders will try to block all Democratic amendments.

The vote-a-rama provides a political function for Democrats, who will attempt to persuade vulnerable senators to cast votes in order to try to influence voters during the midterm elections, in addition to giving senators a chance to discuss specific policy issues.

Following Tillis’ retirement announcement from North Carolina on Sunday, the amendments will mostly target Susan Collins of Maine.

GOP leaders may also propose amendments that target vulnerable Democratic senators, such as Jon Ossoff of Georgia, but Democrats are more motivated to propose so-called gotcha amendments because they are attempting to turn the Senate blue.

Republicans and Democrats may be watching purple-state members running for reelection in 2028 because senators rarely have the chance to propose as many amendments as they like.

by

by