WASHINGTON (States Newsroom) — With just a few days remaining before a self-imposed deadline for the Fourth of July, President Donald Trump urged his fans to call members of Congress and urge them to approve the big, beautiful bill.

Trump’s appeal comes after a number of turbulent days on Capitol Hill during which GOP leaders were unable to reach an agreement on a number of policy issues, particularly after the lawmaker determined that key components of the package did not comply with the intricate requirements for advancing a budget reconciliation bill.

Trump also warned Republicans against rejecting the tax and spending cut proposal during a meeting in the White House’s East Room that was attended by a number of Republican members.

Trump stated, “We don’t want grandstanders.” Not nice folks. They are aware of who I am referring to. I confront them. However, grandstanders are not necessary. We must reclaim our nation and do so with vigor.

Despite mounting resistance from members of the House, some Republican senators are still hopeful they can work through the weekend and that the House votes will be united next week.

Senator Eric Schmitt stated that he does not believe the legislators’ decisions will postpone the votes past the weekend window, which has always been the objective.

However, we’re most likely voting into the weekend. I’m going to guess that. “I don’t think that materially changes too much,” the Missouri Republican said, adding that Saturday and possibly Sunday are still the aim.

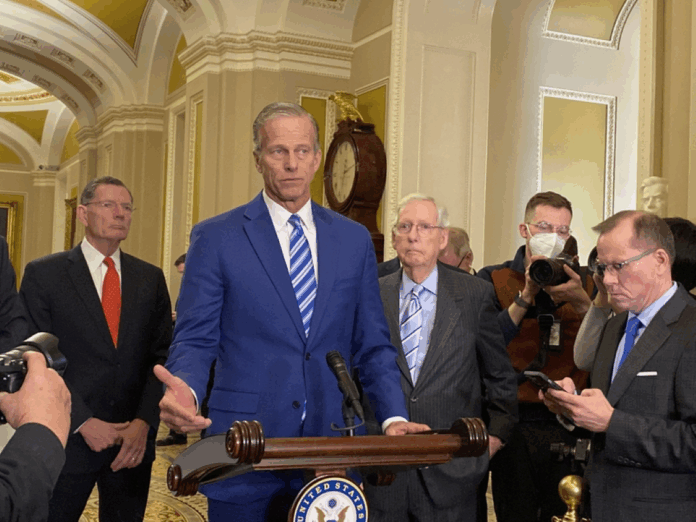

In the afternoon, however, Senate Majority Leader John Thune, R-S.D., seemed less certain, stating to reporters that he was unsure of the time the chamber would hold the procedural vote that initiates floor deliberation.

He said, “I’ll get back to you on that.”

Medicaid provisions tossed

The lawmaker’s decision on Thursday that a number of Medicaid changes in the bill do not comply with the standards dealt a serious blow to Senate Republicans, as it means the GOP would no longer be able to use billions of dollars in savings to offset the cost of tax cuts.

Although more of the panel’s recommendations are still being considered, Finance Committee Chairman Mike Crapo, R-Idaho, must revise or do away with nine of the committee’s recommendations for the health care programs.

Republicans are no longer able to cut back on federal matching money for state governments that pay for Medicaid coverage for undocumented immigrants using their own tax dollars.

Medicaid enrollees cannot be denied gender-affirming care under the GOP measure.

Additionally, Republicans must modify or abandon a plan to lower state Medicaid provider tax credits. This is a seemingly minor health care policy issue, but it has caused a great deal of division within the GOP and sparked strong state resistance.

The modifications or removals will significantly affect the amount of savings the GOP tax and spending cut bill will produce over the course of the next ten years and will probably result in a larger total deficit effect than previously. The purpose of the proposal is to reduce spending and continue the tax cuts from 2017.

The decision may make it harder for Trump and Republican leaders in Congress to secure the votes they need to pass the measure at all, much less before their self-imposed deadline of July 4. GOP leaders in the Senate had stated that they hoped to start procedural votes as early as Friday.

The proposal was already stalled on Wednesday because to escalating disagreements about the effects of Medicaid reforms on rural hospitals and other issues.

Democrats to continue scrutinizing bill

“Democrats will continue to advocate for removing dozens of proposals from the bill that they believe don’t meet reconciliation rules,” said Jeff Merkley, D-Ore., ranking member of the Senate Budget Committee, who announced the lawmakers’ rulings.

Democrats are prepared to carefully examine any modifications and make sure the Byrd Rule is followed, Merkley stated, despite Republicans’ frantic attempts to rewrite portions of this measure in order to forward their objective of billionaires winning and families losing.

According to a staffer who asked not to be named in order to discuss the chairman’s plans, the Finance Committee will revise some clauses in order to comply with reconciliation and Byrd recommendations.

Reconciliation legislation are subject to a number of restrictions under the Byrd rule, which bears the name of former West Virginia Senator Robert Byrd.

According to a statement from Ron Wyden, a Democrat from Oregon and ranking member of the Finance Committee, the parliamentarian’s decision will result in the removal of over $250 billion in health care cuts from the Republicans’ big bad bill.

Americans who are on a tightrope financially will suffer from the health care cuts that Democrats battled and won. I will continue to oppose the cuts in this morally reprehensible measure until the very end because it is completely corrupt.

The lawmaker is still debating whether a number of health provisions—such as one that would prevent all Medicaid financing from flowing to Planned Parenthood, so preventing Medicaid enrollees from accessing the organization for basic medical care—meet reconciliation requirements.

Funding for abortions is currently prohibited by federal law, with the exception of rape, incest, or the life of the pregnant patient.

Later on, the lawmaker will also determine whether the Republicans’ plan may prevent the Department of Health and Human Services from enforcing a rule from the Biden administration that mandates nursing homes have a nurse on duty around-the-clock.

Higher ed provisions axed

The lawmaker also thwarted multiple attempts by Republicans in Congress to reform the system of higher education.

Such restrictions are only applicable to new borrowers, as GOP lawmakers are unable to simplify student loan repayment options for existing borrowers to only a basic repayment plan or an income-driven repayment plan.

Republicans must reject a plan that would have allowed for-profit, unaccredited universities to receive Pell Grants, a federal subsidy that helps low-income students pay for college.

A bill that would have prohibited payments made by students engaged in internships or residency programs in medicine or dentistry from being included toward Public Service Loan Forgiveness was dropped by the lawmaker.

When borrowers fulfill specific requirements, such as working for a qualified employment in the public or nonprofit sectors, the federal program cancels any leftover debt.

The congressman rejected a proposal by Republican lawmakers to deny certain non-citizen immigrants access to federal student funding.

Too many Medicaid cuts

Sen. Josh Hawley, a Republican from Missouri, stated that lawmakers will have an opportunity to correct the Medicaid provider tax rate after the parliamentarian’s decision.

Hawley stated that he favors the House provision that would freeze the rate at 6% rather than lowering it to 3.5% over a number of years, saying that this is an opportunity for the Senate to address an issue that they caused and not defund rural hospitals.

After returning from a NATO summit in Europe, Hawley stated hours before Trump’s event that he expected the president to become more active in discussions. He also claimed that Trump was in a great mood during a recent phone conversation.

I believe he wants this completed. He wants everything done nicely, though. Hawley added that he does not want this to be a plan that lowers Medicaid. He told me that quite clearly. “This is a tax cut bill, not a Medicaid cuts bill,” he stated. You know, I think he’s sick of hearing about all these Medicaid cuts. I am, too. The reason for this is the excessive number of Medicaid cuts.

Early Thursday evening, Republican Senator measure Cassidy of Louisiana urged lawmakers to restore the House’s Medicaid language to the measure, erasing the Finance Committee’s modifications.

My stance is that Medicaid cuts, particularly severe ones, must be avoided. The powerful head of the Health, Education, Labor and Pensions Committee commented on social media that the Senate bill drastically reduces Medicaid. Like President Trump, I think the House version is superior.

SNAP cuts

In order to comply with the rules governing reconciliation, the Agriculture Committee is also revising portions of its measure, some of which are being closely monitored by states.

John Boozman, R-Ark., the chairman of the committee, stated that he anticipates hearing from the lawmaker by Thursday evening regarding whether the final bill will include a new state cost sharing provision for the Supplemental Nutrition Assistance Program that is based on error rate payments.

Since it was rejected the first time, we actually sent her an updated version of the wording. We’ll publish the updated content if she gives her OK, Boozman stated.

Later in the day, the committee issued a statement declaring that the lawmaker had approved the updated state cost share for SNAP, which is determined by the state’s error payment rate.

States with SNAP mistake payment rates greater than 6% will be required to pay a portion of the program’s expenses. Beginning in fiscal 2028, the revised proposal will allow states to choose between fiscal 2025 and fiscal 2026 when determining their match. The mistake payment rate for the previous three fiscal years will then be used to calculate a state’s match.

State and local tax, revenge tax

Additionally, Senate Republicans were unable to agree on a state and local tax deduction level (SALT) that would satisfy House Republicans from high-tax blue states.

According to the House version, taxpayers earning less than $500,000 might deduct up to $40,000 in SALT from their federal taxes. Until they reach a ceiling of $44,000 and $552,000. The $40,000 cap and the $500,000 income level will both rise by 1% a year. For higher earners, the deduction cap gradually decreases.

Several sources state that House Republicans shot down the White House and Senate Republicans’ attempt to decrease the income barrier on Thursday.

Sen. Markwayne Mullin of Oklahoma, who is the Senate Republicans’ principal negotiator on SALT, expressed optimism.

We will be in a favorable position. Mullin stated, “We’re going to find a landing spot.”

A spokesman for the Senate Finance Committee refrained from commenting on ongoing discussions or any suggested adjustments to the income level.

Another tax measure that Treasury Secretary Scott Bessent weighed in on was the so-called vengeance tax on investments from nations whose trade policies the president believes are unjust to American companies.

In a social media post, Bessent urged lawmakers to eliminate the mega-bill’s up to 20% tax after reaching an agreement with his G7 allies.

According to Bessent, this agreement with our G7 allies would boost growth and investment in the US and abroad while also giving the global economy more predictability and stability.

The Committee for a Responsible Federal Budget estimates that the retaliatory tax would have generated about $116 billion over a ten-year period.

Timing on votes

Before their self-imposed deadline, Republican lawmakers have limited time to revise all of the ineligible sections, clear them with the parliamentarian, read the final bill language, endure a drawn-out Senate amendment voting session, and then pass the bill through the House.

During a briefing prior to Trump’s event, White House press secretary Karoline Leavitt stated that, in spite of the most recent ruling, the president is adamant that Congress must enact the large, beautiful package within the next week.

By July 4th, we anticipate that it will be on the president’s desk for signature. “I am aware that the Senate lawmaker issued a decision this morning,” Leavitt stated. You see, this is a natural part of the procedure and the inner workings of the US Senate. However, by Independence Day, the president is determined to get this bill on his desk here at the White House.

by

by