Breaking Down Muskegon Community College’s Budget

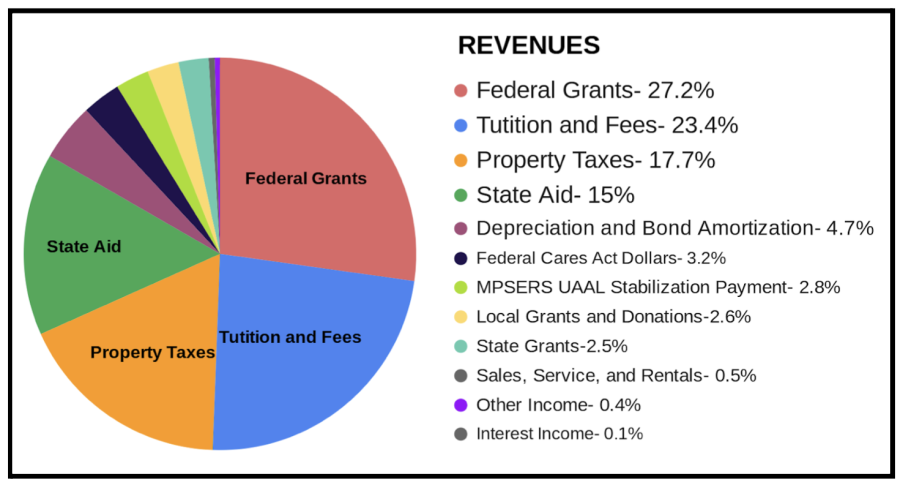

Despite the multiple challenges that have arose amidst the COVID-19 pandemic, MCC has remained on the plus-side in their annual budget. The revenue generated towards the institution is provided via Federal Grants, Tuition and Fees, Property Taxes, State Aid, Etc.

October 30, 2021

Despite the pandemic-related challenges and overall unconventional nature of the the 2021-2022 school year, Muskegon Community College has still managed to keep its annual budget in a surplus of $117,307.

According to college documents, this school year, from August 2021- June 2022, MCC expects to bring in approximately $69,116,872 in revenue. The majority of this money will come from federal grants, tuition, property taxes, and state funds, all of which are typical sources of income for community colleges across the board.

The most lucrative of these funds are federal grants, which accounted for 28.6 percent of MCC’s income. This year, the government invested a total of $18,808,879 into MCC to support students and higher education.

Other key contributors when it comes to how community colleges earn their money include tuition and state aid. With enrollment up 7.8 percent from last year, a better-than-anticipated $16,152,579 was collected from tuition and fees. This total accounts for 24.5 percent of MCC’s total revenue and is the second greatest source of income, only behind federal grant money.

“In terms of the current fiscal year FY22, fall enrollment is higher than last fall, which is a good sign,” said Beth Dick, the new Vice President of Finance and Chief Financial Officer for MCC. “COVID-19 has impacted enrollment; however, the college has received several federal and state grants to help offset that impact as well as cover expenses that have been incurred as the result of COVID.”

In addition, when calculating how much support each community college should receive, the State of Michigan factors in data such as total headcount numbers and student credit hours. So, due to upward trending enrollment and various additional formulated factors, MCC was awarded $10,371,630.

Another reliable source of income for community colleges in general is property taxes. This year, MCC took in a total of $12,249,471 from local property taxes. This money is also essential to running a stable operation without a deficit.

“In summary, the financial results of the college are significantly tied to enrollment, but there are other factors involved such as the state’s budget allocation, property tax revenues, and grants,” Dick said.

The price of operating a community college, especially one as large as MCC, is not cheap. This year’s expenses came to a grand total of $68,999,565 with salaries, scholarships, and benefits among the top costs.

Not surprisingly, salaries and wages were the college’s greatest expense. MCC’s Assistant Director of Human Resources, Kim Salinas, reported that on the college’s most recent payroll, 370 employees were compensated. This includes professors, counselors, faculty members, managers, cleaning staff, and all of the other workers that are part of MCC’s daily operations. This school year, the amount given away in salaries is expected to total $19,184,932, accounting for 27.8 percent of costs. Fringe benefits for these employees are also going to cost the college $9,677,800, or 14 percent of the total expenses.

MCC has also pledged on their website that they will “work with students to provide them with the financial resources necessary to attend college.” To stand by this goal, $14,327,411 was put towards financial aid and scholarships.

It is important to note that these values are still budgeted estimates.

“We continue to monitor actual figures compared to budget throughout the year and react to any variances accordingly,” Dick explains.

Students should also know that funding for sports teams, clubs, and classes are not currently in jeopardy. Dick assured that primary revenues such as tuition and fees, property tax revenues, as well as state aid and grants, support the majority of the operations of the college and provide sufficient funds.

“We will continue to monitor the financial results including cash flow of the college as the year progresses,” she said. “As we look toward future year budgets to determine if cost-savings measures/cuts are warranted.”

Overall, even amidst uncertain times, MCC’s financial health has remained stable and in good standing.